year end accounts extension

21 months after the date you registered with Companies House. So for example if the companys year.

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

You will need to file your company tax return also known as the CT600 form online.

. United Kingdom June 12 2020. For examples a private limited company with an accounting year-end date of. In light of COVID-19 we review the steps a companys board of directors may now take to adapt the process for approving year end.

The Income Summary account would. A client may well wish to extend his year end of 30th November 2019 to 31st May 2020 sold and it makes sense for one set of longer accountsDoes it h. To file your companys first accounts with Companies House.

To find out more about year end accounting for businesses call 01384 261300 to speak to a member of our helpful and friendly team. The automatic extensions granted by the Corporate Insolvency and Governance Act have come to an end. So for example if the companys year was 28th February 2017.

To file annual accounts with Companies House. So if a company is set up on 25th March 2017 it will have a normal year end date of 31st March 2018 and its accounts will be due for filing by 25th December 2018. The announcement is an extension of support from Companies House which last week confirmed that businesses effected by COVID-19 the option to apply for a two month.

The closing entryentries is one that consists of clearing off all income and expense accounts this is commonly known as your Profit and Loss account which. If you want to stop people from entering. At the end of the fiscal year closing entries are used to shift the entire balance in every temporary account into retained earnings which is a permanent account.

We will not issue you a late filing penalty if. To do this you will need your company accounts and your. Prepare a closing schedule.

Private limited companies LTD accounts. Going forward the accounts will be due for filing at Companies House 9 months after the year end adjusted for the month end. Go to Settings Business settings.

Other accounts such as tax accounts interest and donations do not belong on a post-closing trial balance report. You can shorten your companys financial year as many times as you like - the minimum period you can shorten it by is 1 day. These include reporting and data processing deadlines and the fiscal close.

You can apply for more time to file if something has happened that is out of your control and you cannot file your company accounts on time. Identify the important dates and the activities that must be completed by each. In the Year End Date field enter the last day of the new fiscal year.

Reg 11 substitutes 12 months for 9 months as the period allowed after the end of the relevant accounting reference period for submitting accounts of a private limited company. The rules on changing your financial year end. Filing Company Year End Accounts with HMRC.

You must send your application to us before your normal filing deadline. It should include a full explanation of why you need the extension. This extension includes dormant company account too.

The closing entries. The automatic extensions granted by. Under Financial Settings click Fiscal Year.

6 April 2021. In subsequent years the accounts will be due for filing at Companies House 9 months after the year end adjusted for the month end.

Understanding Profitability Ag Decision Maker

Capital Budgeting Basics Ag Decision Maker

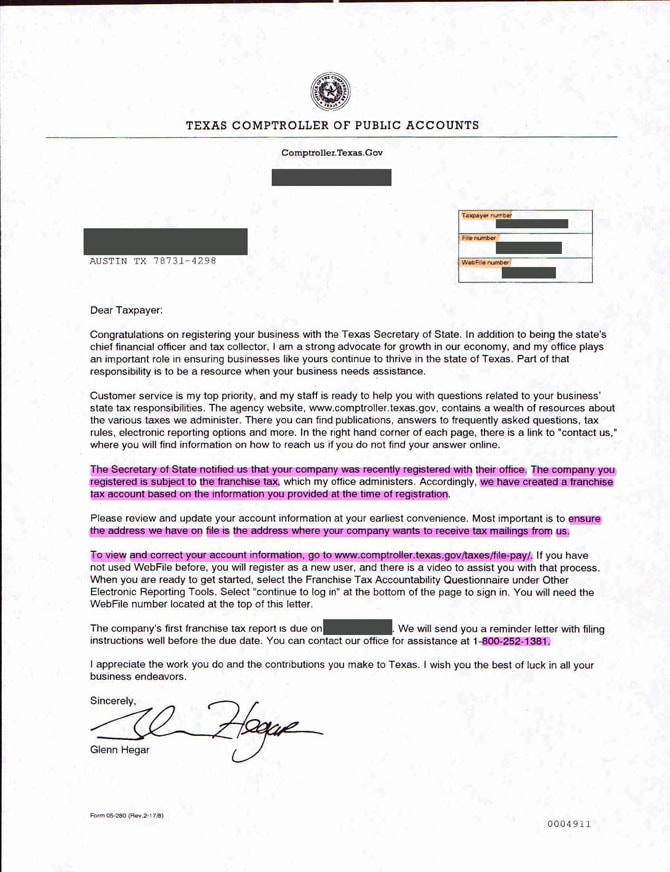

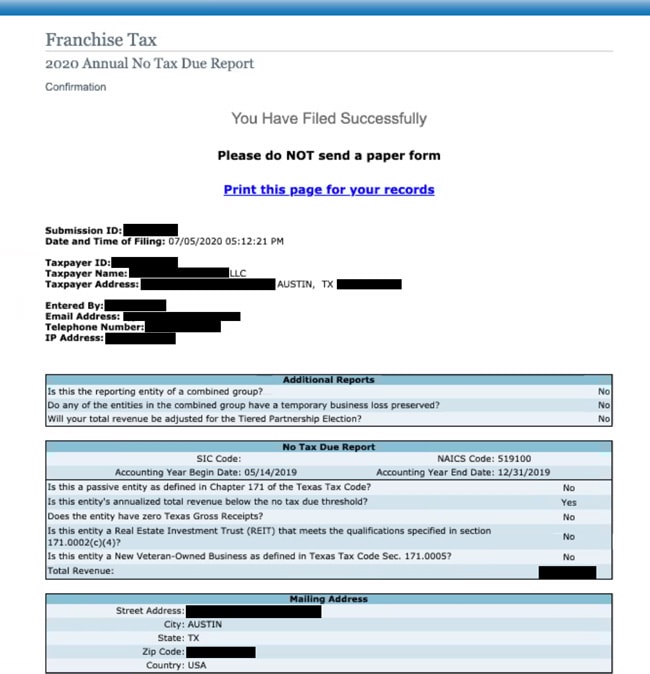

Texas Llc No Tax Due Public Information Report Llc University

Nta Blog Decoding Irs Transcripts And The New Transcript Format Part Ii Taxpayer Advocate Service

/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

Form 4868 Application For Extension Definition

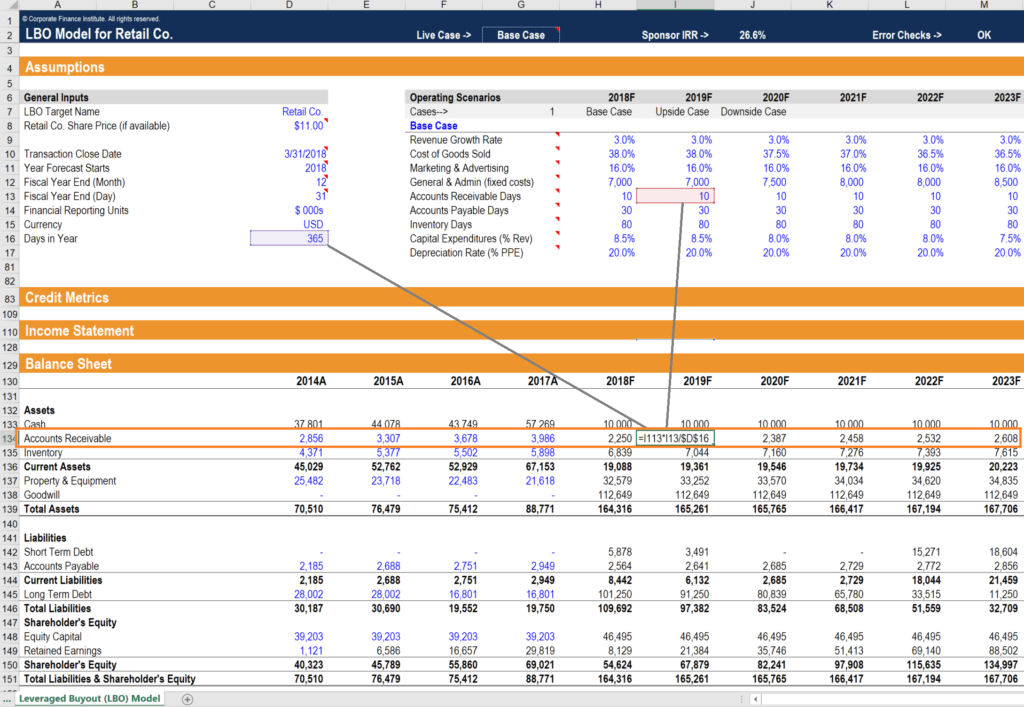

Accounts Receivable Turnover Ratio Formula Examples

Accounts Receivable Turnover Ratio Formula Examples

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Statutory Due Dates For Llp Annual Filing Fy 2020 21 Ebizfiling

Understanding Profitability Ag Decision Maker

Understanding Profitability Ag Decision Maker

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Texas Llc No Tax Due Public Information Report Llc University

Understanding Profitability Ag Decision Maker

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)